Income Limit For Medical 2025. Income numbers are based on your annual or yearly earnings. The current asset limit is $130,000 for one person.

In 2025, if your income is more than $103,000 per year, you’ll pay an irmaa of at least $12.90 each month on top of the cost of your part d premium. In both 2025 and 2025 the costs within medicare, including surcharges, must increase by close to 6.00%.

Limits For Masshealth 2025 Alli Luella, The irs on wednesday released an updated applicable percentage table used to determine a person’s premium tax credit for 2025.

Medicaid Limits 2025 Pa 2025 Merna Stevena, Each additional household member adds $65,000 to the asset limit.

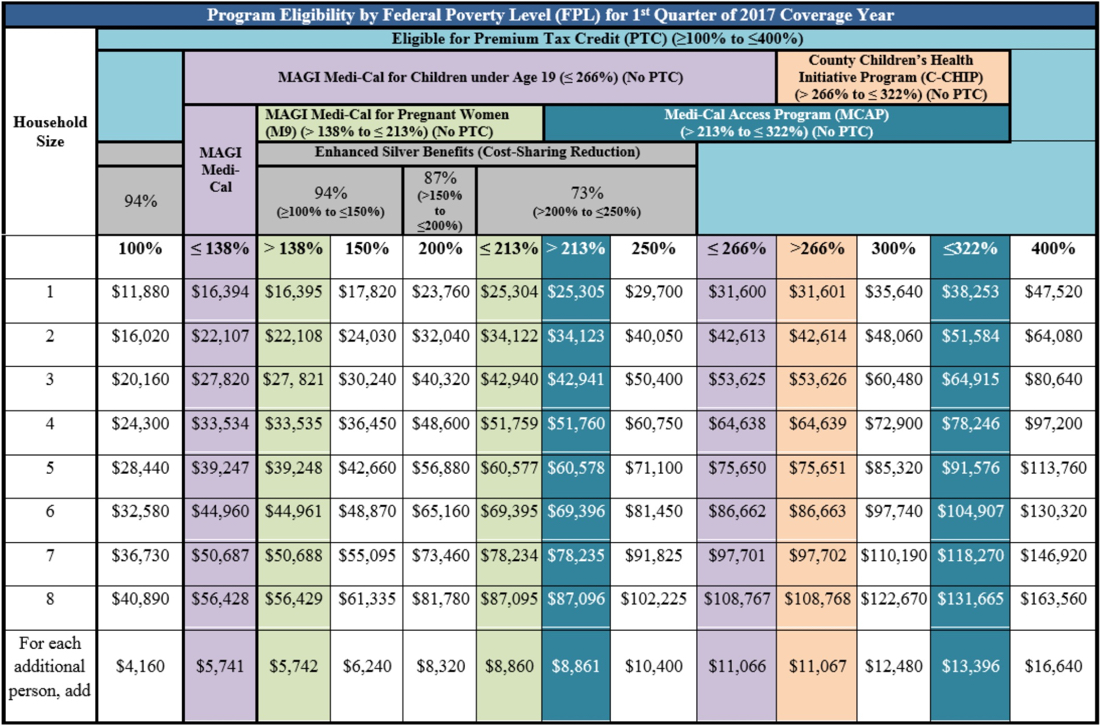

California MediCal Limits 2025 Addie Anstice, The irs on wednesday released an updated applicable percentage table used to determine a person’s premium tax credit for 2025.

Medical Insurance Limit Financial Report, In 2025, if your income is more than $103,000 per year, you’ll pay an irmaa of at least $12.90 each month on top of the cost of your part d premium.

Nys Snap Guidelines 2025 Limits Flor Oriana, Preventative care, primary care, family planning, mental health and substance abuse, emergency services, dental and vision, and prescription?

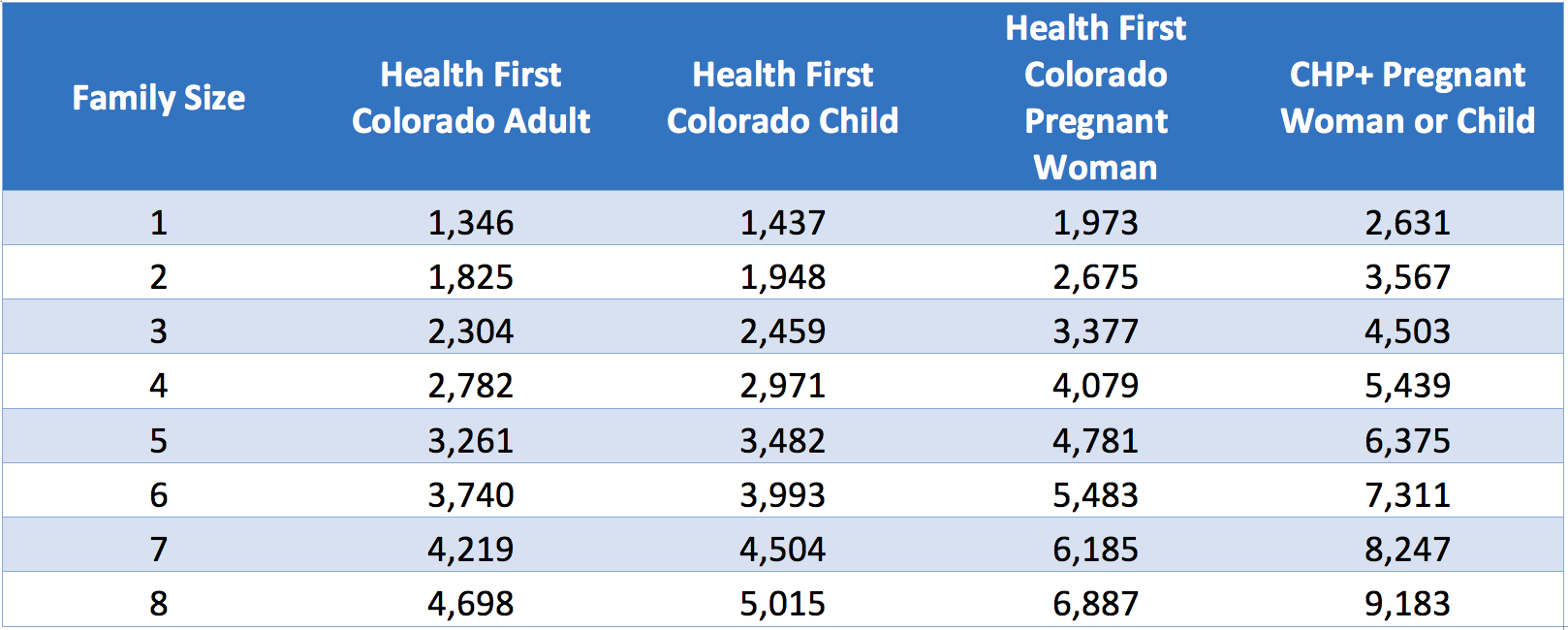

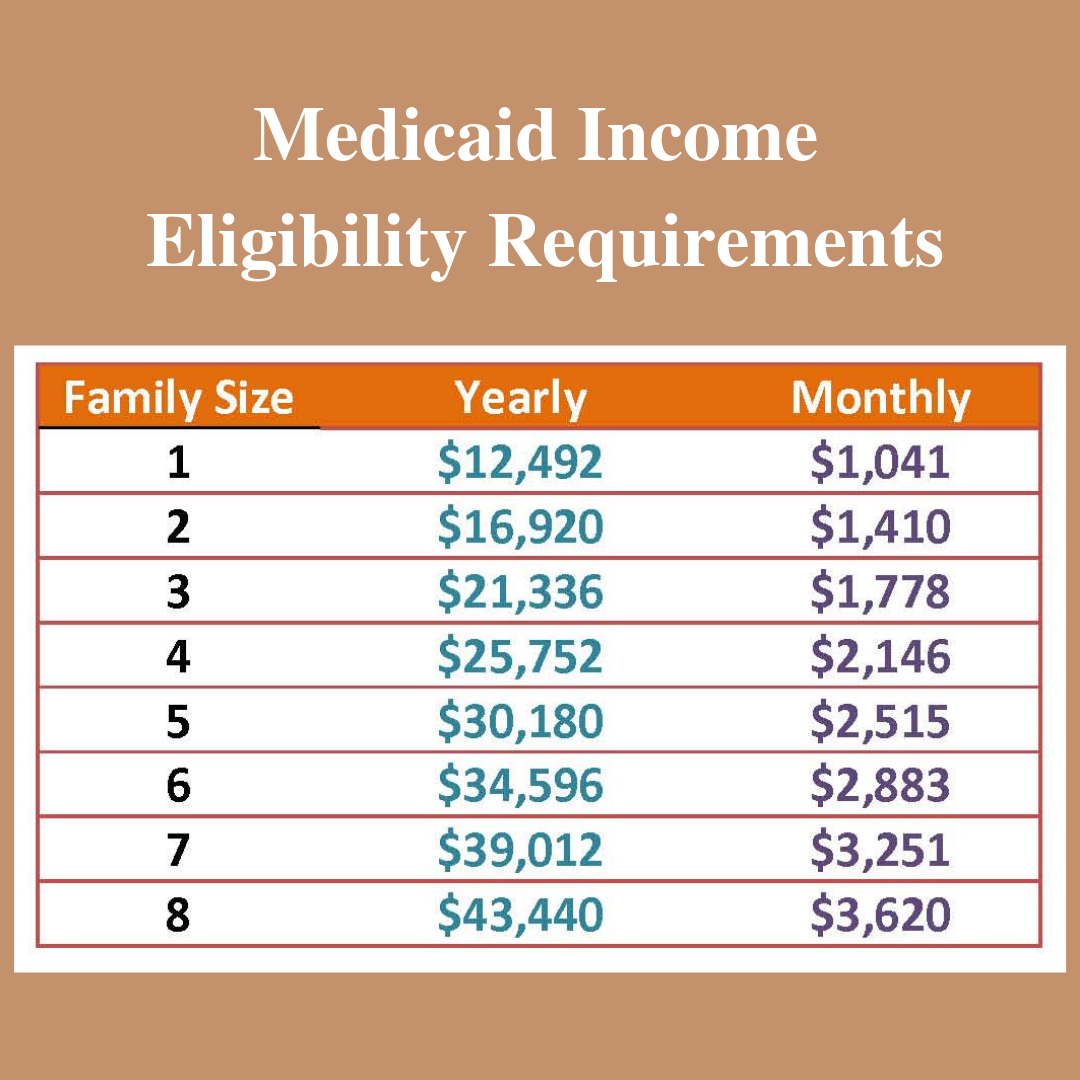

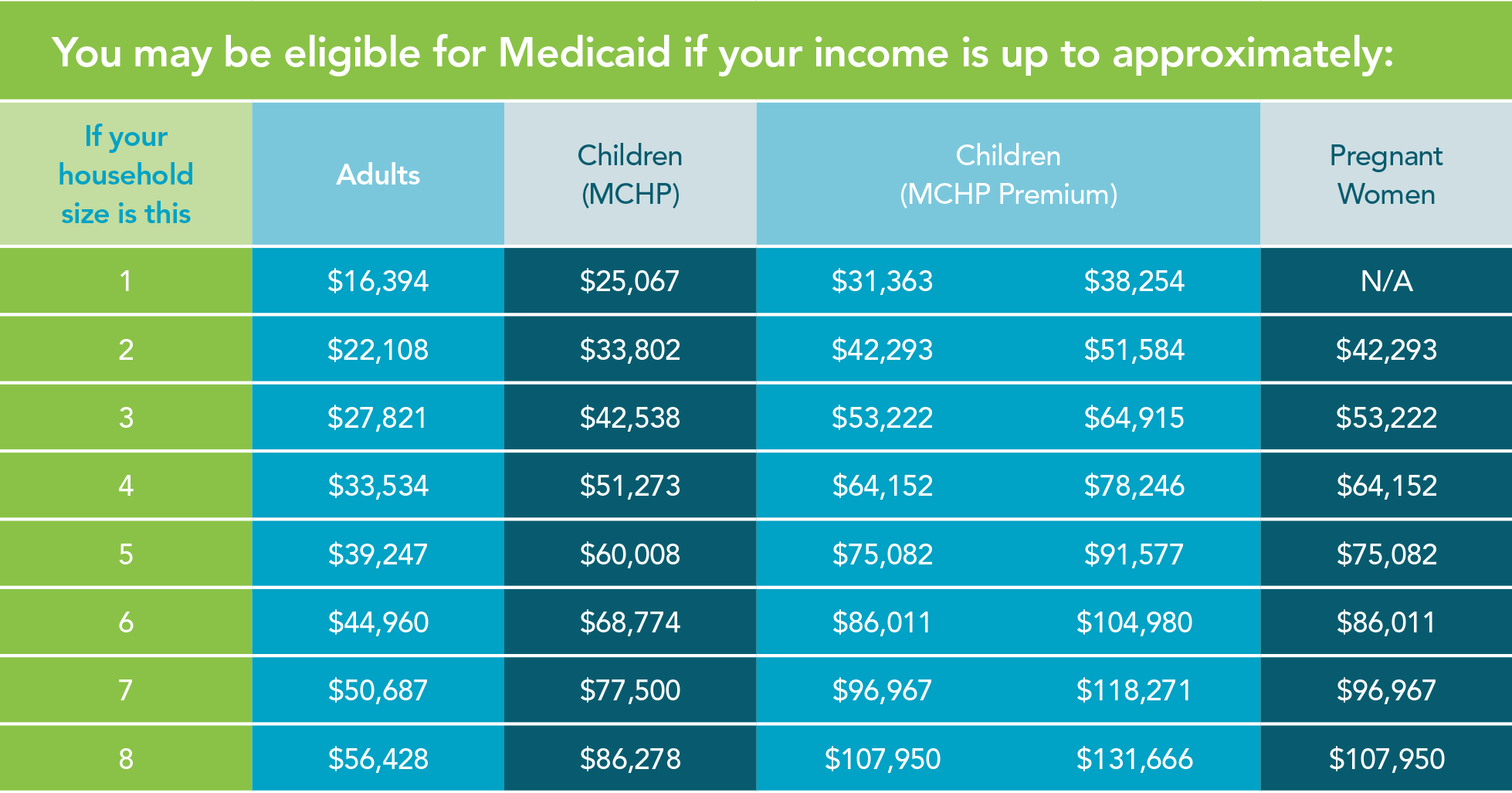

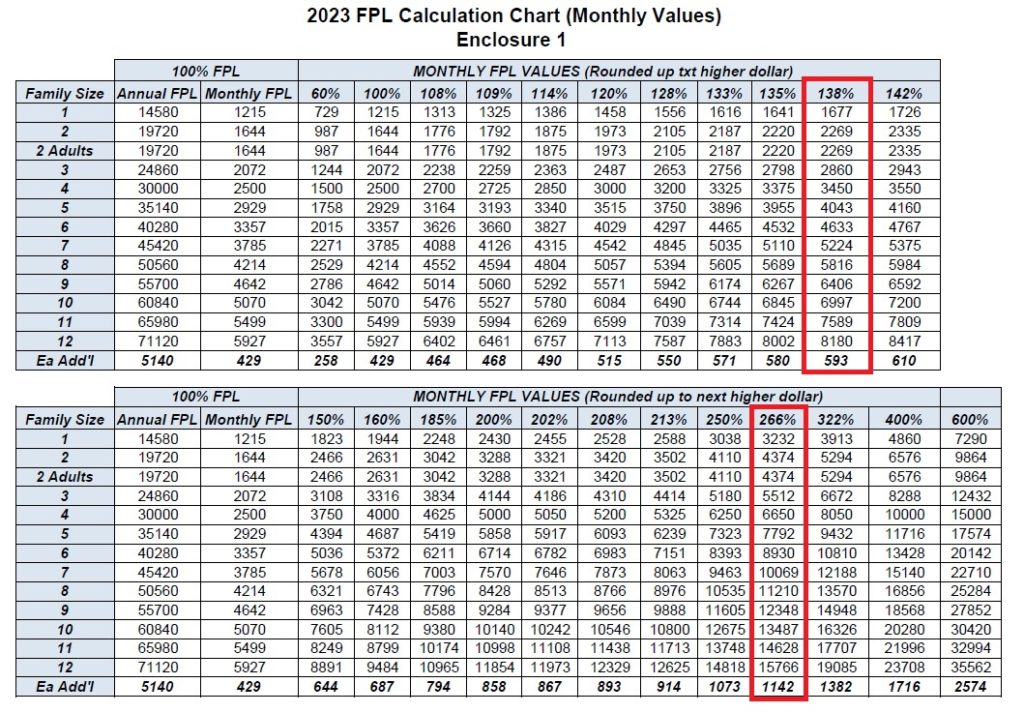

Pa Medicaid Limits 2025 Chart, To see if you qualify based on income, look at the chart below.

Medical Limits 2025 Pdf 2025 Tiffy Melisande, Based on federal tax household and the family size of that tax household, mcap will determine if you meet the mcap eligibility guidelines.

Proudly powered by WordPress | Theme: Appointment Green by Webriti